Possible bill could mean lower textbook prices for students

Senior business management major Brialle Menefee, spends about $300-400 on textbooks each semester.

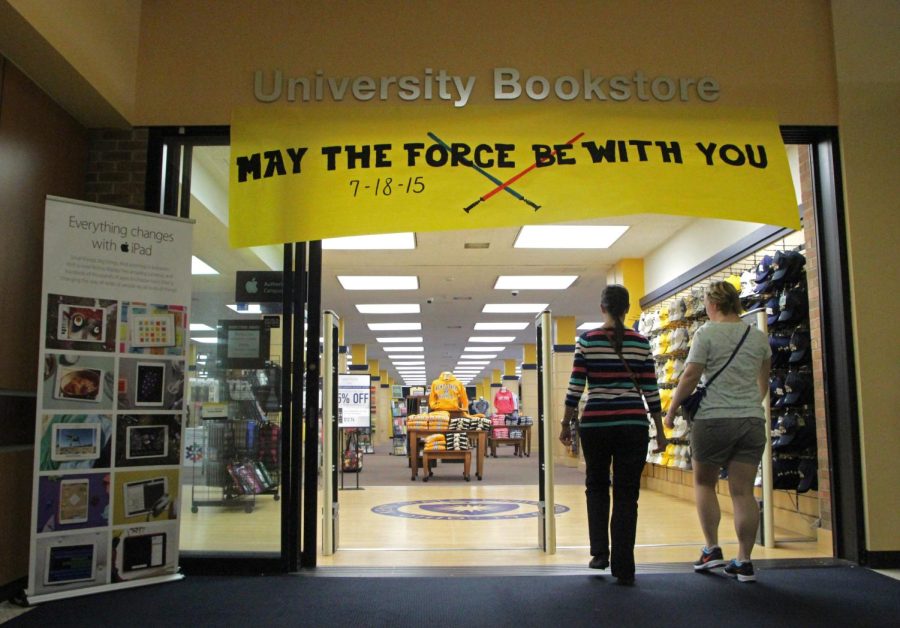

Menefee said that when she buys her books, it’s typically never at the Kent State University Bookstore.

“I can find the same book and either buy or rent them for a lesser price,” she said.

Menefee is one of many students who pay for books that they can’t necessarily afford every semester. According to a report in U.S. News last year, students pay on average $1,200 a year. Last month, Franklin County lawmakers introduced a bill that would exempt sales taxes on textbooks.

Paula Divencenzo, a Kent State tax manager, said that the possible exemption on sales tax could very well make a difference for students.

“A student who pays $600 for books could have $42 in sales tax that they could save,” Divencenzo said. “It may not look like a lot to some people, but for college students, every little bit counts.”

She said that while she is neutral on the proposed bill, she does think that it could cause an issue on campus in terms of security.

“From what I’ve read about it, there will be new rules that would make students use their IDs to purchase books,” she said. “This could cause vendors to have to do more work than they already do.”

Menefee said that a sales tax exemption would be a positive change for college students and would allow them to focus on other expenses.

“I find the tax exemption would save money that can be put towards saving for the debt we have to pay back after college,” she said. “We could also use that money to pay for other necessities such as food and gas.”

Elizabeth Randolph is a senior news editor for The Kent Stater. Contact her at [email protected].