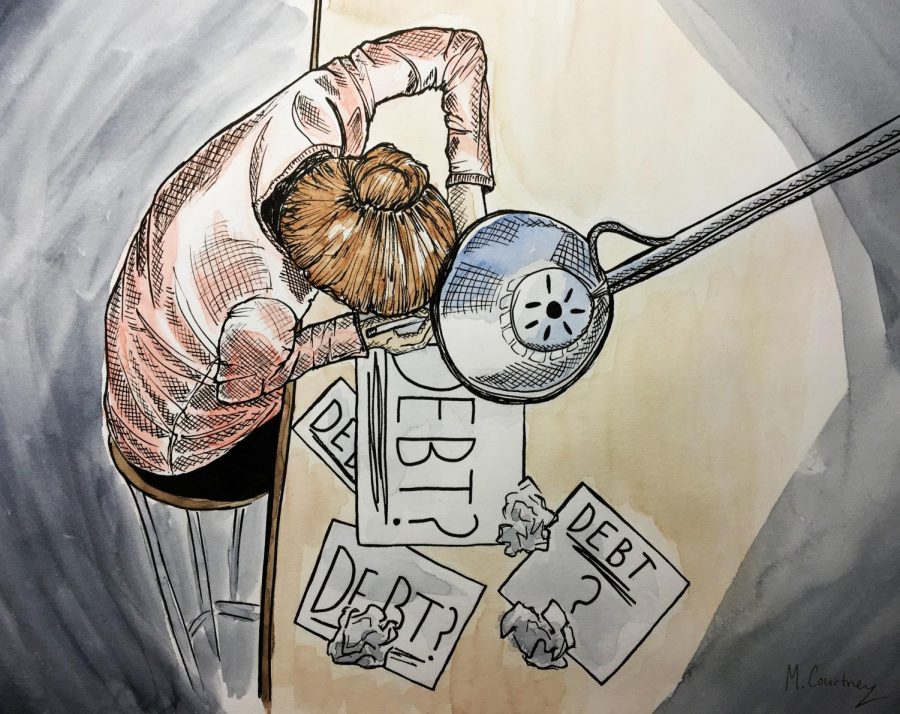

Students get creative to combat college costs

As the national college debt continues to soar, more and more college students are finding ways to help pay for the expenses of attending college.

Magdalene Morley, a sophomore visual communication design (VCD) major, came up with a creative way to obtain more funds for college — a GoFundMe page.

“VCD is expensive. I have to go and buy a specific brand of art supplies every week to use for my projects,” Morley said. “I usually spend about $50 a week on supplies and printing.”

Morley is one of 130,000 students who are trying to raise money on the website for college tuition and expenses. There are currently 4,225 Ohio residents who have raised $1.55 million dollars on the website, according to GoFundMe for College.

It costs a student approximately $18,632 a year to attend a four-year public university, which is nearly six times more than what it was thirty years ago, according to the National Center of Education Statistics.

More than 44 million student borrowers owe greater than $1 trillion in student loans, according to Student Loan Hero. Ohio ranked ninth in the top ten states with the highest college debt.

Like many college students, Morley files the FAFSA every year to obtain government-funded loans to help pay for school. The loans she receives do not cover all of her expenses. To help save money, Morley started taking online classes at Cuyahoga Community College.

For the past 25 years, more than 70 percent of college students have worked while attending college, according to a study conducted at Georgetown University’s Center of Education and the Workforce.

The study concluded students working full-time at the federal minimum wage would earn approximately $15,000 a year — not enough to cover the U.S. average price of attending a public, four-year institution.

“I’ve had three jobs over the past four years and nothing to show of it,” Morley said. “It got to the point that I didn’t know what else to do.”

Michael Scupholm, a senior crafts major, was also able to receive funds through his GoFundMe campaign to finish his last semester at Kent State.

Scupholm almost reached his goal of $3,100 from 17 donors since October. He said he didn’t want to just ask people for money, so in return for a donation, Scupholm gave donors a piece of his glass artwork.

“I was happy to give away my glass artwork as tokens of my appreciation for the donations,” Scupholm said. “I was very fortunate to have supportive donors who helped me pay the rest of my semester’s bills, and I got my artwork out there.”

Scupholm said he appreciates the love and support he got from his donors to help him pay the rest of his tuition.

To obtain more funds to pay for school, students can use their passion to produce extra cash.

Kaitlin Stanaitis, a sophomore VCD major, started selling her artwork in December on several websites to help pay for her tuition.

Stanaitis is studying abroad in Italy this fall and is trying to earn money to use overseas. She currently sells her artwork on Redbubble and Society6, making an extra $10 or so each month. Stanaitis also holds art shows in Lakewood, where she makes the majority of her art-based income.

“The Root Cafe gave me an entire gallery space for a month, and I was able to sell $1,500 worth of art,” Stanaitis said. “This money goes toward school for my weekly art supplies.”

Even with students coming up with creative ways to subside their college tuition bills and debt, students are still suffering the financial consequences of taking out loans.

In 2014, Kent State was third on the list of large public schools with the highest three-year loan default rate. Approximately 14.7 percent of Kent State graduates did not make a student loan payment in over 270 days, according to Quartz.

Schools that have excessive default rates can lose eligibility in one or more federal student aid programs. Excessive default rates conclude a 25 percent default rate over three years, or 40 percent or more in one academic school year, according to the U.S. Department of Education.

“We are continually striving to make college more affordable,” said Jeff Robinson, director of communications at the Ohio Department of Education (ODE). “We are currently reviewing a new two-year budget to freeze tuition costs throughout Ohio.”

The ODE is also working with public colleges to share textbook costs with students. Robinson said this would directly benefit students and their families when budgeting for college.

The ODE also offers students 2-plus-1 and 3-plus-1 programs, where students can attend a community college for two or three years, then finish at a public university. The College Credit Plus program has also been successful for the State of Ohio.

“We’re in the second full-year of this program where students can earn college credit while still attending high school,” Robinson said. “More than 52,000 students in Ohio have participated and have averaged $120 million in savings.”

Kent State University College offers programs to help students pay for tuition. Students can log onto the financial aid website to view a list of various programs and scholarship opportunities.

Students seeking financial awareness can view a list of financial literacy workshops scheduled throughout the semester, including FAFSA completion assistance, scholarship and grant search, student loan consolidation and repayment, personal banking, credit cards and credit scores.

Mikala Lugen is the student finance reporter, contact her at [email protected].